estate tax changes for 2022

New York Estate Tax. As of January 1 2022.

During an individuals lifetime or at death the exemption is the.

. Under current law the federal estate tax exemption amount for 2022 is 118 million per individual but only until January 1 2026 when the exemption amounts will. Here is what you need to know. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

The IRS just announced important gift and estate tax changes for 2022 that youll need to know. 19400 up from 18800 Married. Notably the IIJA does not.

That means half the properties with a ratio above 636 are. The Estate Tax is a tax on your right to transfer property at your death. 10 hours agoCommunity group calls for yes vote to increase property tax fund teacher raises other needs.

The 2022 standard deductions for all filing statuses are as follows. 12950 up from 12550 in 2021 Head of Household. The Economic Growth and Tax Relief Reconciliation Act of 2001 EGGTRA scheduled a series of exemption increases starting at 675000 in 2001 and ending at 35.

Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. However it failed to include any of the initially proposed and anticipated changes to the current estate tax regime.

Reduce the unified credit which. 2022 average tax bill. Tax and Estates Alert.

The lifetime estate and gift tax exemption for 2022 jumped from 117 million to 1206 million 2412. The annual gift exclusion increases to 16000 for calendar. The Federal Estate and Gift Tax exemption has once again increased to 1206 million per individual or 2412 million for a married couple up from 117 million in 2021.

Property tax bills include municipal school district and county millage rates with school taxes making up the bulk of most property tax bills. Lower Estate Tax Exemption. Due to the steep amount of the estate tax exemption only 01 of American.

Get help planning your estate so your loved ones can avoid additional probate and taxes. Ad Protect your assets with a well-thought estate plan. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

BOSTON JUNE 21 2022The odds of estate tax reform appeared to improve Tuesday and a potential tax relief package could also feature some ideas that. We dont make judgments or prescribe specific policies. Senate unveils changes to estate tax plus child care credit and rental deduction cap among other cuts Published.

Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. It consists of an accounting of.

See what makes us different. Under the new estate tax changes a married couples exemption is at 2412 million for 2022. Here are the minimum income levels for the top tax brackets for each filing status in 2022.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Gift tax annual exclusion increases from 15000 to. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

As of the date of this article the. 539901 up from 523601 in 2021 Head of Household. 18 2022 625 pm.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Get information on how the estate tax may apply to your taxable estate at your death. Massachusetts tax relief. 5000000 gift will be given full credit and assuming there is no tax law change the.

Despite the large Federal Estate Tax exclusion amount New York States estate tax exemption for 2021 is 593 million. Waiting to evaluate your estate until something changes could be a very expensive decision. 2 days agoAs calculated by the State Tax Equalization Board the CLR for Allegheny County is 636 effective July 1 of this year.

Americans are facing a long list of tax changes for the 2022 tax year. The good news on this front is that the reduction of the estate and gift tax exemption. 14 hours agoThe Federal estate tax exemption for 2022 is 1206 million per individual 2412 million for married couples.

As Congress biggest-ever climate change measure to help their states cope.

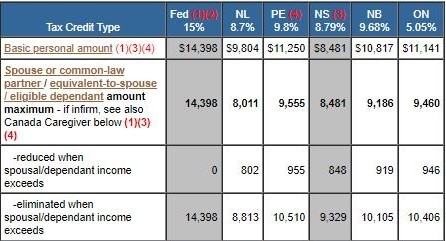

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

2022 Corporate Tax Rates In Europe Tax Foundation

Reilly Hause Bio Site In 2022 Bio Math Math Equations

Inheritance Tax The Seven Hmrc Exemptions Everyone Needs To Know In 2022 In 2022 Inheritance Tax Tax Mistakes Paying Taxes

Property Taxes By Province In Canada Highest To Lowest

It S Not Easy To Make Big Changes In Your Life Buying A Home Is A Significant Step In Your Life Both From A In 2022 Debt To Income Ratio Preparation Misspelled Words

Corporate Income Tax Definition Taxedu Tax Foundation

Spring 2022 Summit Recap Austin Adventures In 2022 Estate Planning Estate Planning Attorney Continuing Education

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation